The Bureau of Internal Revenue (BIR) recently posted a memorandum that clarifies the tax obligations of all social media influencers, individual or corporation. But who are social media influencers in the eyes of the BIR? What are those obligations? And why did the BIR have to issue this memo?

According to the BIR, they have received reports that certain social media influencers have not been paying their income taxes despite earning huge income from different social platforms. The agency also said the there are reports that they are not registered with the BIR or are registered under different tax types or line of business but are not declaring their earnings.

The BIR said that the end goal is to raise revenues from their undeclared income and to remind social media influencers of their tax obligations under the law and that failure to pay taxes has possible consequences.

Who are the “social media influencers?”

According to the Circular, “social media influencers” includes all taxpayers, individuals or corporations, receiving income, in cash or in kind, from any social media sites and platforms (YouTube, Facebook, Instagram, Twitter, TikTok, Reddit, Snapchat, etc.) in exchange for services performed as bloggers, video bloggers or “vloggers” or as an influencer, in general, and from any other activities performed on such social media sites and platforms.

In other words, if you earn money from social media platforms, you need to pay your taxes.

What are those taxes?

The BIR said that social media influencers shall be liable to income tax and Percentage or Value-Added Tax unless exempted to the provisions of the National Internal Revenue Code (NIRC) of 1997, as amended, and other existing laws.

Social media influencers are classified for tax purposes as self-employed individuals or persons engaged in trade or business as sole proprietors, so their income is considered as business income.

The BIR listed the following as the source of income for social media influencers:

• YouTube Partner Program – Ad revenue, channel membership, merch shelf, Super Chat and Super Stickers, YouTube Premium Revenue

• Sponsored social and blog posts

• Display advertising

• Becoming a brand representative/ambassador

• Affiliate marketing

• Co-creating product lines

• Promoting own products

• Photo and video sales

• Digital courses, subscriptions, e-books

• Podcasts and webinars

‘X-deals’ are covered as the BIR said that if a social media influencer receives free products in exchange for the promotion on YouTube or other social media accounts, he/she/it must declare the fair market value of such products as income.

Social media influencers are also liable for business tax, which may be either be percentage or VAT.

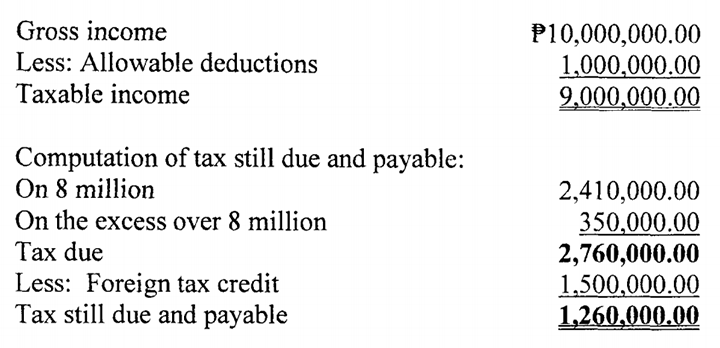

The BIR also clarified allowable deductions from gross income, which are expenses paid or incurred related to the production or realization of the income, as long as the influencer can provide BIR-registered receipts and invoices. Here’s an example the BIR provided in the case of YouTubers:

• filming expenses (cameras, smartphones, microphone and other filming equipment);

• computer equipment;

• subscription and software licensing fees;

• internet and communication expenses;

• home office expenses (ex. proportionate rent and utilities expenses);

• office supplies;

• business expenses (e.g. travel or transportation expenses related to YouTube business, payment to an independent contractor or company for video editing, costume designer, advertising and marketing costs (cost of contests and giveaway prizes, etc.);

• depreciation expense; and,

• bank charges And shipping fees.

Earnings from YouTube

To fix the withholding tax rate to be applied on all income payments (royalties) from YouTube, the BIR also advises social media influencers residing in the Philippines who are earning from the platform to submit their tax information to Google to be eligible to claim treaty benefits under the tax treaty between the Philippines and the US.

Under Article 13(2)(a) of the Philippines-US tax treaty, royalties derived by a resident of the Philippines may be taxable in the US but such tax shall not exceed 15% of the gross amount of royalties. If the PH-based influencer doesn’t submit his/her tax information, Google will impose a maximum rate of 24%.

Below is an example computation by the BIR:

What will happen if you don’t file returns and pay taxes?

If an influencer attempts to evade or defeat tax, that’s punishable by a fine not less than PHP 500K, but not more than PHP 10M, and imprisonment of not less than 6 years but not more than 10 years.

If an influencer fails to file return, supply correct and accurate information, pay tax withhold and remit tax, and refund excess taxes withheld, it’s punishable by a fine of not less than PHP 10K and imprisonment of not less than 1 year but not more than 10 years.

This shouldn’t come as a surprise

The BIR has issued memos before that are similar to this. In 2020, it reminded online sellers, freelancers, bloggers, filmmakers, and content creators earning from digital ads to register their businesses and pay their taxes. The Tax Code of the Philippines already covers that.

In other words, anyone who makes an income is taxable. It’s the law. Even the freebies in purchases or prizes you won in contests like gadgets, makeup kits, appliances, and trips. Sometimes, the companies that gave those freebies have already shouldered the taxes. Sometimes, they are not, so the recipient is responsible for declaring them.

The standard process involves an Official Receipt (OR). This is the basic route for declaring that payment has been received in exchange for promotion.

Just a reminder. Taxation of any income is nothing new. The BIR is just reminding everyone, especially, the social media influencers, to voluntary and truthfully declare their income and pay their corresponding taxes

For more information on income tax, click here — Income Tax – Bureau of Internal Revenue (bir.gov.ph)

The post A closer look at the BIR tax memo for Social Media Influencers appeared first on YugaTech | Philippines Tech News & Reviews.

Source: Yugatech

No comments:

Post a Comment